(english.gz.gov.cn)

Salaries & Work Hours

The Guangzhou Municipal Government provides that the salaries paid by an enterprise to employees must not be lower than the minimum standard applicable for the year (1550 per month since May 1st, 2013).

The Labor Law stipulates that the working hours of an employee must not exceed the prescribed limit, and that overtime hours must be paid at prescribed rates.

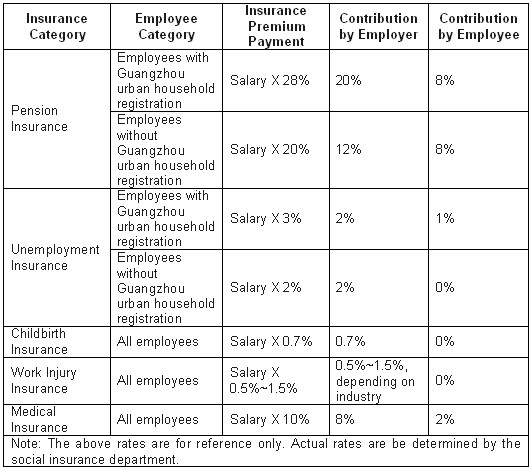

Social Insurance

Guangzhou directs that all enterprises and their employees should participate in social insurance programs according to national, provincial and municipal regulations and pay insurance premiums.

Taxation

Foreign-related enterprises (FIEs) based in Guangzhou are subject to taxation by the Guangzhou Municipal Office of the State Administration of Taxation and Guangzhou Local Tax Bureau.

Guangzhou-based FIEs are liable to the following taxes:

1. Taxes levied by national tax authorities: VAT, consumption tax, vehicle purchase tax, and all taxes levied by Guangzhou Municipal Government on ocean petroleum enterprises.

2. Taxes levied by local tax authorities: business tax, urban land use tax, land VAT, corporate income tax, urban real estate tax, resources tax, vehicle and vessel tax, stamp duty, etc.

3. Foreign nationals working in Guangzhou should file tax returns in accordance with the Guangzhou Administrative Provisions on Personal Income Tax Information Reporting by Foreign Individuals.

For information on preferential tax policies, please call 12366

※ Guangzhou Local Tax Bureau

Add: Guangzhou Local Tax Bureau Building, No. 46, Jixiang Road

Website: http://gz.gdltax.gov.cn

※ Guangzhou Municipal Office of State Administration of Taxation

Add: No. 3, Huaxia Road

Website: www.gzntax.gov.cn